Why is Data Analytics Important in Risk Management?

Data analytics is the birthplace of great business practices in the 21st century. The marriage of hardline data and influential business intelligence insights means a level of awareness and reactivity for businesses that was never before possible. Learn the answers to why is data analytics important in risk management?

Why Data Analytics is Crucial for Risk Management

We’ve just been through an economic roller coaster set off by the COVID-19 pandemic crisis. Many businesses’ vacillating between crisis and risk management, when their main focus right now should be on risk management. So can data analytics inform a viable risk management strategy?

Data analytics doesn’t just empower a better risk management strategy: it is crucial to an effective one. By exploring why, you can come to better support your own risk management decisions through a comprehensive view of your data.

Why Data Analytics is Crucial

Data analytics is crucial in risk management for the primary reason that it provides exceptional transparency. In any industry, an abundance of risk factors can create a threat to your revenues. With data analytics paired with sound data science, you can navigate ideal solutions for your business. However, you’ll need to understand what this entails.

First, understand that data analytics and data science are similar fields, but they don’t take on all the same roles. Data science, for example, focuses more on designing the algorithms and functions to draw out insights from data sets. This is likely something you’ll outsource to AI-powered software or an experienced data scientist.

Data analytics, on the other hand, is the communicative side of managing data. This is especially crucial when it comes to risk management. All kinds of business risks are present in the typical workplace.

These business risks include:

- Strategic risks

- Compliance risks

- Financial risks

- Operational risks

Knowing where these risks are present is one thing. However, communicating the scope of these risks and how important it is to avoid them takes a different set of skills. Expert data analysts can draw up graphics, stories, and conversations regarding the applicability of data. In turn, businesses can mitigate risks more accurately.

Without these insights and the expertise to communicate them, you are likely to be surprised when a disruption occurs in your workflow. To avoid risks, empower your operations with data analytics.

How to Empower Risk Management through Data Analytics

Risk management is entirely dependent on your awareness of all potential problems. No approach to preventing risk will be completely successful since there is no way any business could plan for every eventuality. However, big data analysis gives us the tools we need to mitigate as much risk as possible.

This is because of the tools that data analytics gives us in each stage of the risk mitigation process. From research and understanding to the resolution of the risk, we can apply data towards a safer and more stable operation.

Here’s how data analytics empowers the process:

Understanding All Factors

The first step in any comprehensive risk management plan is understanding all the factors involved. Crises will require different action plans than your everyday operational risks, but keeping an inventory of common potential problems is a step in the right direction.

Data analytics can help you in this regard by demonstrating industry or location data for you to compare, contrast, and assemble patterns from. Understand what the probability is for risk factors, ranging from natural disasters to crime, all based on area rates. Data analytics helps you collate these insights.

Identifying Risk Factors

Then, you can apply data analytics in identifying your own risk factors. This means conducting a thorough risk assessment and pairing your findings with the research you’ve already done.

For example, ask yourself, what risk correlations does my data show?

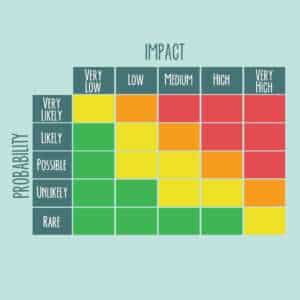

A great way to answer this question is by assembling a risk assessment matrix. This is a tool that allows you to monitor risks in terms of impact and likelihood so you can balance business practices accordingly. From here, you are in a better position to manage risks with greater success.

Managing The Risk Cycle

The last stage in the risk management cycle is the management stage. This involves addressing the problem by implementing a new procedure to prevent the risk. Maybe your solution won’t eradicate risks entirely, but it will still prevent the problem from showing up as a pressing danger in your ongoing data analysis efforts.

Data analytics helps with this by offering predictive insights. If you were to change one factor, how might that influence risk? You can explore all kinds of potential solutions through data modeling, a common feature of modern data management platforms.

Mitigating Business Risks

Conducting any kind of business in the uncertain modern economy can be a daunting prospect full of risks. But data is here to help, so take advantage of it in your risk management strategies. Use data to understand, identify, then execute the best solutions for any danger or problematic situation that rears its head.

Applying data analytics using these methods will maximize your potential to mitigate destructive business risks. After going through a recession-inducing global pandemic, this is peace of mind everyone should strive for in their organizations.

Leave a Reply